It may also tell you about your privateness rights and how the law protects you. If you’re struggling to get approved, you would additionally consider automobile finance with a black box. Applying for automobile finance couldn’t be any simpler with GetCarFinanceHere.

If you have a historical past of dependable borrowing, you may find you’re eligible for a decrease rate than anyone with missed funds on their file. We perceive that it isn’t all the time straightforward to maintain a perfect credit historical past. We determined to develop Go Car Credit as we perceive anyone may have problems getting credit score through traditional banks. The main focus is moral and responsible lending and treating clients pretty. We use Open Banking because it allows us to process loan applications effectively, securely and in our prospects’ best interests.

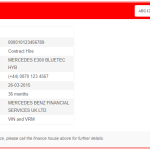

Where a set payment, the quantity of fee may be influenced by your creditworthiness and the chance of lending to you, otherwise generally known as ‘rate for risk’. The larger the risk, the upper the band of interest rate charged to the borrower typically leading to much less fee paid to us from the lender because of the elevated threat of default or cancellation. The lenders we work with could pay commission at different charges. However, the quantity of commission that we obtain from a lender doesn’t influence the quantity that you just pay to that lender under your credit settlement. Hire purchase is a means of shopping for a automotive on finance, where the loan is secured towards the automotive. You’ll must pay a deposit of around 10%, then make fixed monthly payments over an agreed time period.

What is the simplest car to get with dangerous credit?

- 2019 Hyundai Elantra SE.

- 2019 Mitsubishi Mirage G4 ES.

- 2019 Nissan Versa Sedan S Plus.

- 2019 Ford Fiesta S.

- 2019 Hyundai Accent SE.

- 2019 Mitsubishi Mirage ES.

- 2019 Chevrolet Spark.

- 2019 Nissan Versa Sedan S. Monthly cost for good credit: $202.

Car finance lenders are doubtlessly pledging 1000’s of pounds to someone they’ve never met. Performing background financial checks is a means for them to danger assess purposes and determine how doubtless it is for them to get their a refund. Here at Hippo Leasing we consider drivers of all credit backgrounds and work with our lenders to offer inexpensive month-to-month repayment plans to swimsuit you. Even with a low credit score rating, you probably can present your potential mortgage lenders that you are less of a risk by sharing documents that may showcase your financial stability.

Placing Service Earlier Than Profit

We cover the vast majority of UK sellers and might prepare funding on most automobiles. AA Car Finance is here to simplify your next car buy by allowing you to choose your automotive and finance multi function place. We’re on a mission to demystify automobile finance, make everything extra transparent, and clearly clarify the basics. Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry.

- For your reassurance, all the lenders we work with could pay commission at different rates, however the fee we obtain doesn’t influence the rate of interest you’ll pay.

- The FCA retains an inventory of what it calls clone companies – those pretending to be a respectable lender.

- Helping them right into a automobile they need and onto a better street forward.

You can apply for automotive finance with Zuto without impacting your credit score score. We’ll then approach our lenders and share the choices with you. If you decide to proceed, we’ll perform a ‘hard search’ which is when your credit rating might be affected. You can apply for bad credit automotive finance when you have a default, however your possibilities of being accredited are more likely to be lower as a outcome of default itself impacting your credit score. So when evaluating car finance prices, benefit from our no credit score verify automotive finance services. This strategy is guaranteed to go away no mark in your credit score historical past.

As such, those with good finances may battle to get credit score just because their recorded historical past is clean. If you might have a better rating, lenders ought to reflect this by charging you much less curiosity. Most leasing arrangements are restricted to new automobiles, however PCP finance is available for each new and used autos which would possibly be typically less than four years old. This supplies much more choices with a higher range of vehicles to choose from, throughout a wider price vary. Meanwhile, with PCP, if the car is value more than the optional ultimate fee when you hand the keys again then you’ll additionally have the ability to ‘commerce it in’ and put this distinction – often recognized as equity – in course of a deposit on your next car.

In these situations, it’s doubtless that only a exhausting search will be completed, as the value of property excessive, that means that the owner has to make certain that the applicant is capable of stick in to their fee plan. Account info – to see whether or not or not you’ve made earlier funds on time. Furthermore, it is suggested that you space out functions when potential to avoid having too many onerous checks occurring at the similar time. No more than one utility each three months is beneficial.

Based on your poor credit score history, the lender is putting his/her cash at excessive danger. Because of this, they have an inclination to supply larger interest rates than ordinary to recoup potential losses. These elevated costs make getting automobile finance with no credit score verify one of the most costly methods to buy a car. It’s when a financial company checks reference agencies’ information for your credit score historical past. So if you want the best deal, it’s best to get a ‘soft verify.’ It just isn’t the kind of formal course of by which a lender determines if you can qualify for a mortgage. We source and make available used automobiles and provide finance to our clients.