It is suitable for small courier deliveries and family trips out of city. Even basic variations of the Mitsubishi L200 have all the mandatory options for comfy driving. You can return the automobile to us should you’re not one hundred pc with 7-day a reimbursement guarantee.

And there are no hidden charges – the price you see is the worth you pay. By applying for finance with us we are going to conduct a credit search on your file. There’s no want to fret about upfront costs, you simply make one simple, manageable payment at a time.

Sure To Poor Credit Van Finance

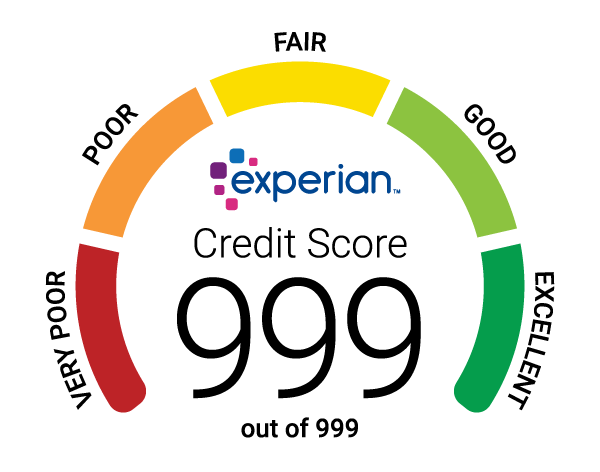

Taking out vans on finance is a good way to save your small business cash. However, as with every sort of financing, you will first need to be approved by a lender. As you could be using the vehicle, but have not paid up-front in full, your credit rating will be used to determine how likely you are to pay again the instalments.

At Refused Car Finance, we can help you get permitted for poor credit van finance right now. We might be automotive finance specialists, but we now have a variety of lending packages obtainable to you in case you are seeking to get a used van on finance. We supply a range of reliable, and affordable vans inside your monthly price range for business or personal use.

If you’re not sure as to why your previous utility was declined please check out our weblog submit “Why have I been refused automobile finance? All lenders have their very own criteria, so just because you were declined from one lender, doesn’t mean you’ll be from another. If you are 18+, reside within the UK, are not bankrupt and may show your affordability, we ought to always have the ability that will help you. Any Car Online are one of the UK’s main specialists in Bad Credit Van Leasing. We work with an enormous range of specialist poor credit score funders, as nicely as offering our own in-house poor credit van leasing options.

Rivian Stock Price Prediction 2025 – Nasdaq

Rivian Stock Price Prediction 2025.

Posted: Mon, 18 Jul 2022 22:59:33 GMT [source]

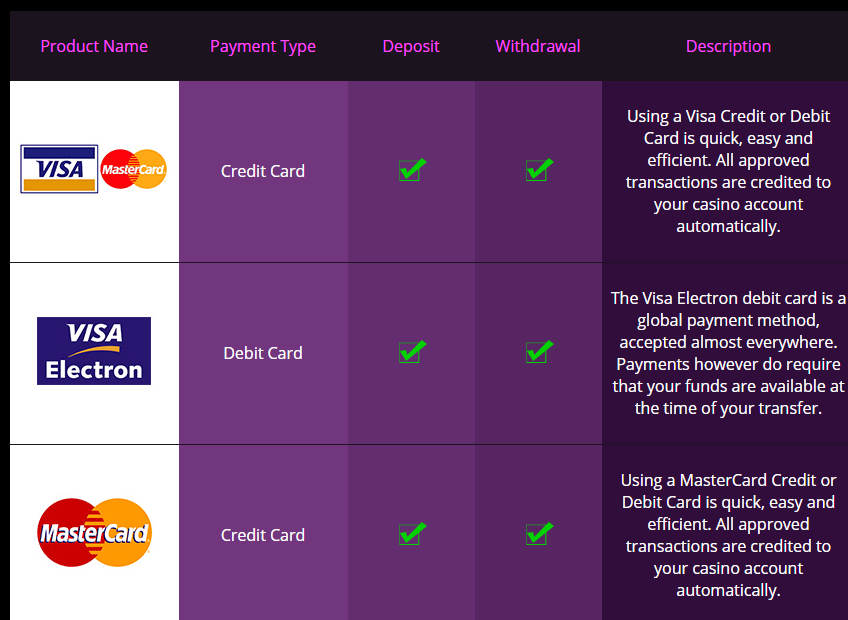

For adverts the place we’ve included our associate Zuto’s finance data, they pay us a fee each time a customer makes use of a mortgage approved by them to purchase a vehicle. With our leasing providing, we get paid a commission every time a buyer takes a lease agreement from considered one of our leasing providers. It is possible for 2 individuals to use for van finance together, which is recognized as a joint software. This normally happens when one of the two has a poor credit history, however the different does not, which increases the former’s probability of successfully applying for a loan.

Do You Require Used Automotive Finance However Have Unhealthy Credit?

Unlike the finance choices above, a private mortgage is unsecured, which implies there isn’t a threat of shedding you be unable to maintain to the instalments. However this may mean the interest rates are greater, and folks with bad credit often discover unsecured loans tougher to obtain than secured loans. Depreciation, or the difference between what the automobile is value at the start of the deal and what it’s price at the end, is key to the price of a PCP deal since it’s this cash distinction that you’re financing. New cars lose nicely over half their value in their first three years and lots of lose up to 30% of their first year alone.

Should you write-off your car without complete insurance you’ll still be liable to repay your mortgage. We provide a complete insurance product by way of Ford Insure. Ford Credit provides fastened rate agreements, so you’ll know precisely what you may be paying from the outset over the time period of the agreement.