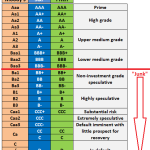

Bad credit automobile finance is a type of mortgage obtainable to those that have a poor credit history and have been unable to borrow elsewhere. Car finance covers three various kinds of finance products, these are Hire buy , Personal contract purchase and private loans. Compare car loansIf you have a poor credit score historical past, you may find that lenders give you larger interest rates, fewer lending choices, or may refuse to lend.

What Is The Average Car Loan Interest Rate? – Forbes

What Is The Average Car Loan Interest Rate?.

Posted: Mon, 18 Jul 2022 09:00:31 GMT [source]

This consists of the condition of the automobile, remaining guarantee, aftercare service, even supplier reputation. What’s more, with a used car there could additionally be age and mileage necessities from the lender. In addition, these with unfavorable credit ratings rating could additionally be limited within the quantities they’ll borrow, or want to offer more safety corresponding to a guarantor or collateral .

Finder.com is an independent comparison platform and knowledge service that aims to offer you the instruments you have to make higher choices. While we’re impartial, the provides that appear on this web site are from companies from which finder.com receives compensation. We might receive compensation from our companions for placement of their services or products. We may also receive compensation should you click on on certain links posted on our web site.

It’s a a lot much less formal course of in which the lender establishes whether you’re more likely to be eligible for sure deals or offers. It isn’t tied to a proper software and the search can’t be seen by other lenders. To be on the protected aspect, inform the lender you want them to make a gentle verify when simply getting quotes. BuyaCar provides a helpful finance eligibility checker that has no influence on your credit rating. So when comparing car finance costs, benefit from our no credit examine car finance companies. This method is assured to depart no mark in your credit score history.

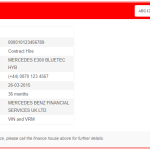

Credit Score Verify For Automotive Finance Tip #1: Enhance Your Credit Rating

Please be aware that if you select a unique car throughout your decision to purchase, the rate of interest out there from the lender might differ. Should this be the case, we are going to ensure that you receive a new quotation. You may have the ability to obtain finance for your purchase from other lenders and you’re inspired to seek different quotations. If you might be not sure on what your credit is, it’s crucial to verify it first. If you may be sad or underwhelmed by your credit rating, you can evaluate your credit reviews for any incorrect information and then dispute these conflicting errors.

Third party service providers similar to Perfect Data Solutions Ltd, trading as Lending Metrics who collect and process your data in reference to such credit score checks by way of credit reference agencies similar to Equifax . One way to attempt to reduce the impact of the default in your credit file when making use of for automotive finance is to add a ‘notice of correction’. This is a brief statement that outlines the reasoning behind the default, which lenders will be capable of view while assessing your software for credit score.

Rated 5 Stars

We don’t cost fees for our providers nonetheless, we might be paid a fee for introducing you to our selective group of lenders , which is set by the lender. In many circumstances, these would be part of checks and will negatively impact your likelihood for approval, but during a credit score report, you aren’t allowed to be judged on these elements. The more cash you place down, the less you’ll need to borrow from the lender in your automotive. Lenders will often contemplate a ration based mostly on your loan quantity v the worth of the automobile you may be applying for, thus bettering your probabilities of a more manageable interest rate. If fraudsters or any other sort of criminal gain entry to your personal particulars, they might take out credit in your name without you being consulted.

- The Introducer’s privacy coverage will apply to all such processing as a lot as and including the introduction to us.

- You should positively strive everything in your power to improve your chances for a successful credit verify.

- Dealers are inclined to have decrease necessities for a finance settlement as a outcome of you’re securing a mortgage against the car, so they can repossess it if you’re unable to keep up with the finance payments.

- Make the funds for this on time and you may construct up your credit historical past.

- The larger your score, the better your credit standing will be and this improves your probabilities of being accepted for automotive finance.