There is nothing to stop you getting your excellent automotive with bad credit car leasing . A credit score score is a means lenders choose how reliable you are when borrowing. Lenders will often examine your previous borrowing and repayment information and use them to discover out whether or not you are a threat or not. We can normally get you permitted for a automotive loan so lengthy as you might be keeping up along with your present debt ranges, your credit score isn’t at all times a deciding factor. We carry out a delicate search in your credit score report which doesn’t have any impact on your credit score rating as at this stage no footprint is left.

If you not want to proceed together with your agreement, step one is to contact the lender as quickly as potential They can then ask the automotive dealership to reverse the deal and return the funds to them. The Mercedes A-Class is an expensive hatchback that’s fashionable to take a glance at, packs a punch when it comes to efficiency and has a extensive range of engines so that you can choose from. In 2021, it was top-of-the-line promoting vehicles of the yr and also features on our list of the most effective hatchbacks 2022! Get your Mercedes A-Class finance sorted today so that you may be behind the wheel in no time.

Automotive Finance For Bad Credit Historical Past

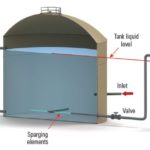

By figuring out your individual earnings and expenditure and utilizing our poor credit score car finance calculator, you might get an idea of what you will be able to afford earlier than you apply with us. At Carvine, we make the bad credit car finance application a breeze. We search and examine your automotive finance choices to get you one of the best value available without any onerous searches. The increasingly in style third option really helpful by GetCarFinanceHere is the payment box methodology. This includes a ‘black box’ being put in in the automotive to make sure that funds are made.

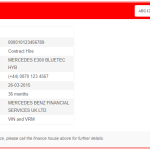

We are much more comfy now and in january we had cleared all funds and so on that have been outstanding like late bill funds and so on. He can easily afford the finance instance mercedes give for personal buyers which is around 6k deposit and £420ish month-to-month payments. By utilizing our car finance eligibility checker, you’re agreeing to allow us to have a look at your credit score file and carry out an affordability verify. We’ll use the findings to give you a sign of whether your utility is more likely to be accepted, and a personalised rate of interest and month-to-month fee. This verify will only be visible to you and the quote won’t affect your credit score.

We might allow you to get the car finance you need although you’ve been beforehand refused by another direct lender or have decreased finance options. Here at Go Car Credit, we are finance specialists in helping individuals who could have had bad credit in the past and are actually experiencing borrowing points from mainstream lenders. We want to make sure your expertise is straightforward, stress-free and environment friendly, from making your application to driving away in your new car. We provide a specialist form of Hire Purchase car finance, our criteria could allow you to get permitted for car finance even in case you are struggling to get other forms of credit score such as a personal loan. Some leasing companies might also enable a ‘guarantor’, who is appointed to take duty in your month-to-month payment ought to you end up in issue and unable to pay on time. Any such guarantor would want to have an exceptional credit rating so as to qualify.

Is 540 a low credit score score?

Your score falls throughout the vary of scores, from 300 to 579, thought-about Very Poor. A 540 FICO® Score is considerably under the common credit score rating.

The supplier will be offering you a substantial sum in these applications, so it’s pure that they will need to do their due diligence earlier than providing this huge sum of money to the applicant. This is not any reason to fret, as you can’t be penalised due to your credit score history as equal employment rules are in place to ensure everybody has a good probability at opportunities no matter their background. Some dealerships and brokers will allow lenders to carry out a delicate search which allows them to see how any loans or finance agreements are presently being managed or have beforehand been managed. It does not go away a mark in your credit profile and it helps to determines how doubtless you are to be supplied automobile finance. While there aren’t a ton of options for getting automobile finance without a credit score verify, it isn’t impossible. You can get a co-signer who guarantees the finance, meaning they take over the payments should you can now not afford the mortgage.